tax avoidance vs tax evasion hmrc

Tax evasion is a criminal act which perpetrators can face prosecution for it while tax avoidance can be seen as using the loopholes in. Tax Evasion Understatingconcealing income or overstatingfabricating expenses would be classed as tax evasion.

Uk What Do The Latest Hmrc Regional Trade Stats Tell Us About Scotland S Exports Https Spice Spotlight Scot 2018 09 10 W Investing Scotland Country Region

Not filing a tax return hiding taxable assets from HMRC or using fake offshore accounts.

. In September 2021 HMRC published revised estimates which put the tax gap at 35 billion for 201920 representing 53 of total tax liabilities. Within recent time however there are cases where avoidance is declared as illegal. The difference between tax avoidance and tax evasion essentially comes down to legality.

And as best I can tell it remains the case that tax avoidance is not illegal. The Government of any country offers areas and multiple options to the public and entities in reducing and encouraging investments that serve as tax-saving instruments. Heavy Tax Avoidance Offshore corporations and specifically designed tax avoidance schemes would usually fall into this category.

This policy paper sets out the governments approach and achievements in tackling tax avoidance evasion and other forms of non-compliance. Tax avoidance involves using whatever legal means you choose to reduce your current or future tax liabilities. Tax evasion refers to the adoption of illegal methods for reducing liability of payment of taxes such as manipulation of business accounts understating of incomes or overstating of expenses etc whereas tax avoidance is the legal way to reduce the tax liability by following the methods that are allowed in the income tax laws of the country.

Crossing that line can lead to hefty fines and prosecution. But tax evasion is illegal. Definitions and Differences Tax evasion means concealing income or information from tax authorities and its illegal.

While tax evasion requires the use of illegal methods to avoid paying proper taxes tax avoidance uses legal means to lower the obligations of. Well taxation has been receiving much attention and this means that the debate has been an. Tax Evasion vs.

Its not always easy to see where one ends and the other begins. HMRC have confirmed that they have secured billions of pounds in additional tax revenue over recent years. Tax avoidance involves bending the rules of the tax system to gain a tax advantage that Parliament never intended.

Tax evasion is where someone acts against the law to escape paying tax that should be. It is estimated that in 201920 the financial loss from tax avoidance was 15 billion while the cost of tax evasion was 55 billion. Tax Evasion is a known fraud of not paying the liable taxes while Tax Avoidance is a well-structured plan to identify methods to reduce the outflow towards tax payments.

In its most simplistic form there are plenty of people whose financial actions may be labelled as tax avoidance. My understanding is that tax avoidance refers to legal methods of reducing a tax liability whereas tax evasion refers to illegal methods. Tax lost due to failure to take reasonable care accounts for the largest proportion at 19 67 billion tax avoidance accounts for the smallest proportion at four per cent 15 billion while the cost of tax evasion was 55 billion.

Instant Download Mail Paper Copy or Hard Copy Delivery Start and Order Now. Tax avoidance means legally reducing your. Tax avoidance means exploiting the system to find ways to reduce how much tax you owe.

Dont try to find out more about the tax evasion or let anyone know youre making a. How does this work. Tax evasion means concealing income or information from the HMRC and its illegal.

Ad The Leading Online Publisher of National and State-specific Legal Documents. Most people avoid taxes in some way or another. Avoiding tax is legal but it is easy for the former to become the latter.

For instance claiming expenses for your work uniform is tax avoidance and is perfectly legal. It is split into three chapters and outlines HMRCs. Tax evasion means doing illegal things to avoid paying taxes.

Tax avoidance is the reduction of a tax bill through legal means whilst tax evasion is the non-payment of tax that is legally due. The amount of tax lost in Britain through non-payment avoidance and fraud has increased to 35bn according to official figures. Its because theres a difference between tax avoidance and tax evasion.

HM Revenue and Customs said the. Well one massive difference is that tax evasion is illegal while tax avoidance is legal well to a certain extent anyway. Tax avoidance is often defined in opposition to tax evasion with tax evasion being illegal and tax avoidance being legal.

The HMRC definition is similar in this regard making reference to the spirit of the law. This comes after a push towards cracking down on tax avoidance evasion and non-compliance. There is tax avoidance or tax planning which is completely legal.

Its the Al Capone path to financial freedom. Report someone to HM Revenue and Customs HMRC if you think theyre evading tax. We have gathered examples from recent and historic high-profile cases to help you unpick the fine line between tax avoidance and tax evasion.

One is illegal the other is legal though arguably immoral when done on a larger scale. The HMRC looses an estimated sum of 40 billion annually through tax evasion and avoidance.

Tax Avoidance Tax Planning And Tax Evasion What S The Difference The Accountancy Partnership

Hmrc Lost 5 5bn In Tax Evasion Black Hole Over Pre Pandemic Year

Benefits Fraud Vs Tax Evasion Cost To The British Taxpayer R Labouruk

Tax Avoidance Haven Risk Management

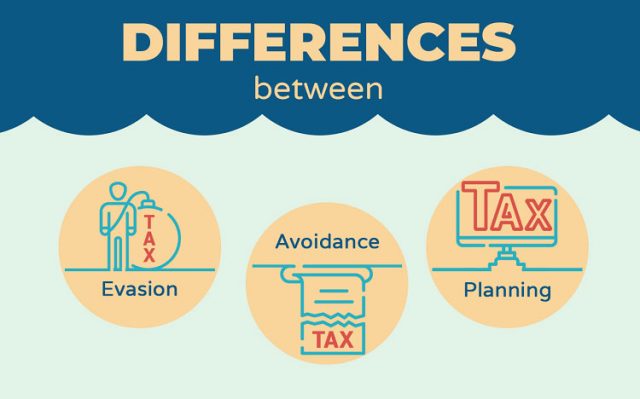

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Vs Tax Evasion Understand The Difference Youtube

The Charity Commission Is To Focus On Compliance By Charity Legal Obligations Rigour Which It Holds Charities Accounting Services Wales England Sample Resume

Tax Evasion Wiki Thereaderwiki

Explainer What S The Difference Between Tax Avoidance And Evasion

Tax Evasion Vs Benefit Fraud R Ukpolitics

John Wade On Twitter Read It And Weep Social Awareness Graphing

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Vs Tax Evasion What S The Difference

How Much Does It Cost To Replace A Lost Driving Licence Driving License Accounting Tax Accountant

Differences Between Tax Evasion Tax Avoidance And Tax Planning